CONTACT US TODAY! - (305) 394-3690 FKLSEmail@Gmail.com

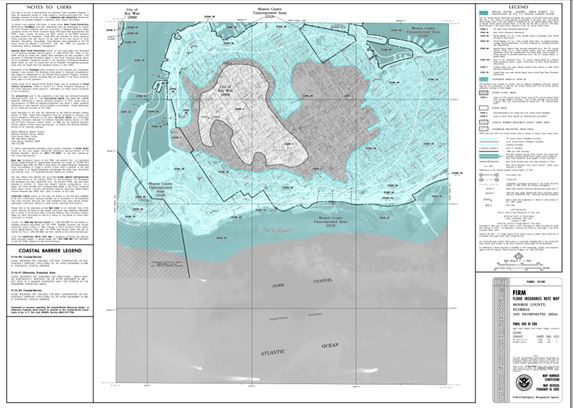

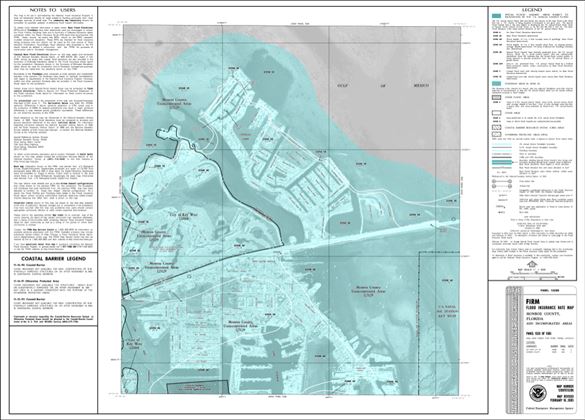

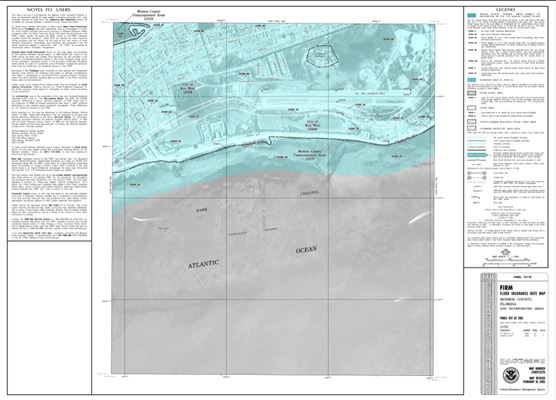

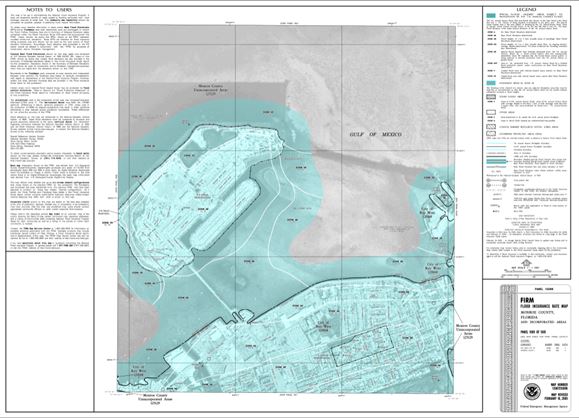

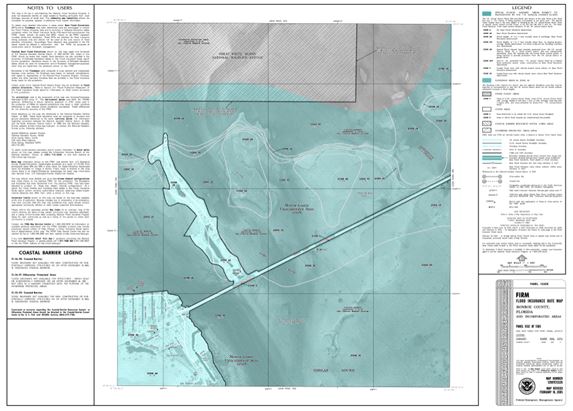

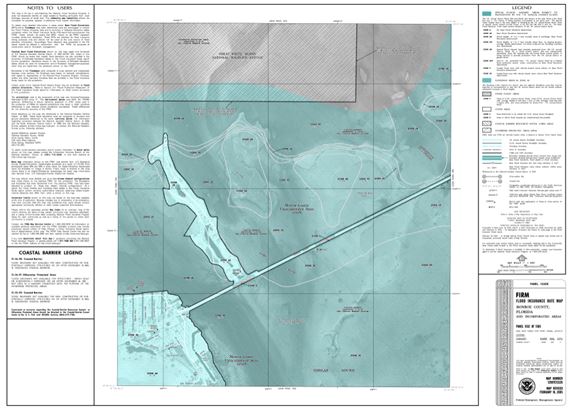

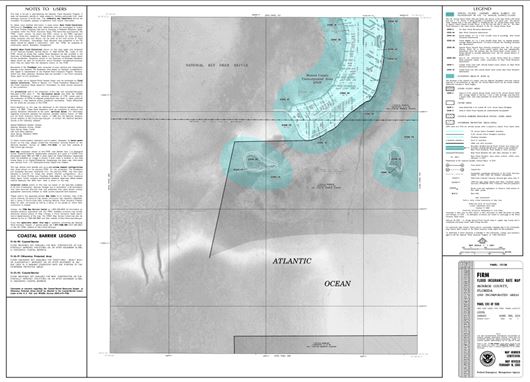

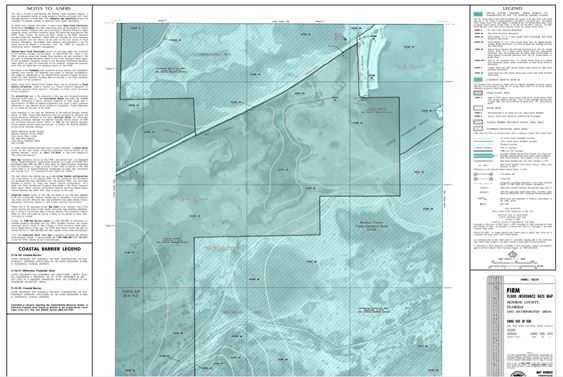

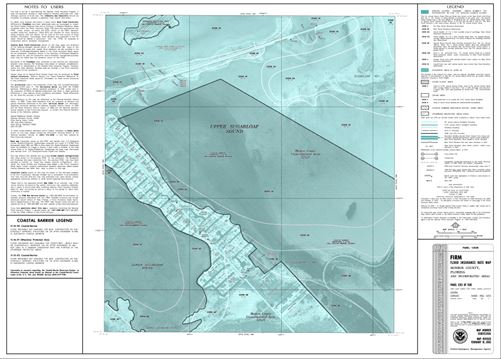

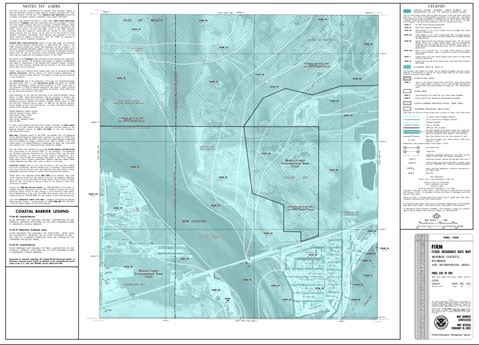

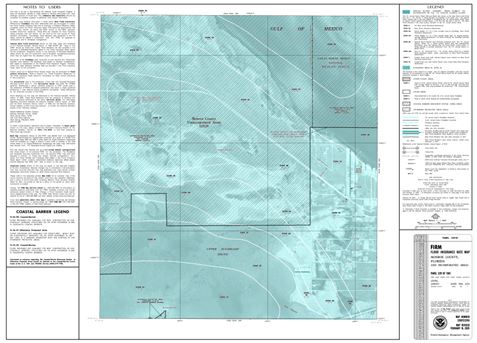

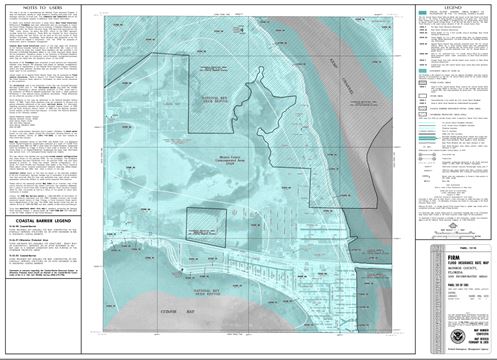

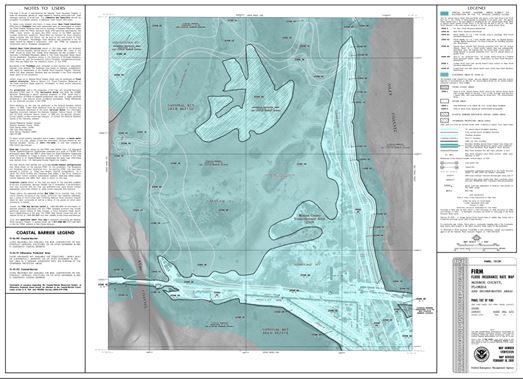

Florida Keys Land Surveying employs the latest GIS Data directly from FEMA to ensure that your Elevation Certificate is the most accurate possible. We have years of experience with Elevation Certificates in the Florida Keys and understand some of the challenges that homeowners can face. Having an accurate and concise Elevation Certificate prepared by Florida Keys Land Surveying will help your insurance agent, to ensure that your property is properly insured and that you are paying the correct premium amount. Contact us to discuss you property and what we can do for you.

An Elevation Certificate is an important tool that documents your building’s elevation. If you live in a Special Flood Hazard Area, SUCH AS THE FLORIDA KEYS, you should provide an up to date Elevation Certificate to your insurance agent to ensure that your property is properly protected and that you are being charged the correct premium amount.

When comparing your building’s elevation to a potential flood level:

Your insurance agent will use the Elevation Certificate to compare your building’s elevation to the Base Flood Elevation (BFE).

The BFE identifies how high the water is likely to rise in a base flood. The land area of the base flood is called the Special Flood Hazard Area.

Flood insurance rates in a Special Flood Hazard Area (a zone beginning with the letter A or V) are based on a building’s elevation above, at, or below the BFE.

Generally, in Special Flood Hazard Areas, the higher above the BFE a building is located, the lower the insurance premium will be for that property. The Elevation Certificate provides the documentation necessary to make that determination.

More information can be found at FEMA's "Homeowners Guide to Elevation Certificates". (CLICK HERE)

The 2024 Hurricase season according to the Department of Atmospheric Science.We anticipate that the 2024 Atlantic basin hurricane season will be extremely active. Current El Niño conditions are likely to transition to La Niña conditions this summer/fall, leading to hurricane-favorable wind shear conditions. Sea surface temperatures in the eastern and central Atlantic are currently at record warm levels and are anticipated to remain well above average for the upcoming hurricane season. A warmer-than-normal tropical Atlantic provides a more conducive dynamic and thermodynamic environment for hurricane formation and intensification. This forecast is of above-normal confidence for an early April outlook. We anticipate a well above-average probability for major hurricanes making landfall along the continental United States coastline and in the Caribbean. As with all hurricane seasons, coastal residents are reminded that it only takes one hurricane making landfall to make it an active season. Thorough preparations should be made every season, regardless of predicted activity.